pet insurance companies in alabama made simple

Start with what matters to you

You want coverage you can trust, that's simple to use, and won't surprise you later. Prices and terms can shift a bit by ZIP code, breed, and age, so exact numbers vary, but the decision doesn't have to feel complicated.

- Core coverage: accidents, illnesses, diagnostics, imaging, surgeries, hospital stays.

- Reimbursement and deductible: common choices are 70 - 90% reimbursement with an annual deductible.

- Waiting periods: usually a few days for accidents and longer for illnesses; orthopedic issues can have special rules.

- Claims flow: app-based claims are standard; a few offer direct pay to vets, but reimbursement after you pay is still most common.

- Exclusions: pre-existing conditions, preventive care (unless you add wellness), and some dental or behavioral items.

- Local reality: heartworm, snakebites, and storm-related injuries aren't rare; check how each policy handles those.

How pricing typically looks in Alabama

For many pets, you might see monthly quotes that often land in a mid-range - cats lower, large dogs higher - but outliers happen. City matters: Birmingham, Huntsville, Mobile, Montgomery, and Tuscaloosa can price differently due to vet costs. Age and breed risk swing things, too.

Plan types you'll encounter

- Accident-only: least expensive, covers mishaps, not illnesses.

- Accident + illness: the go-to for most families; broad coverage.

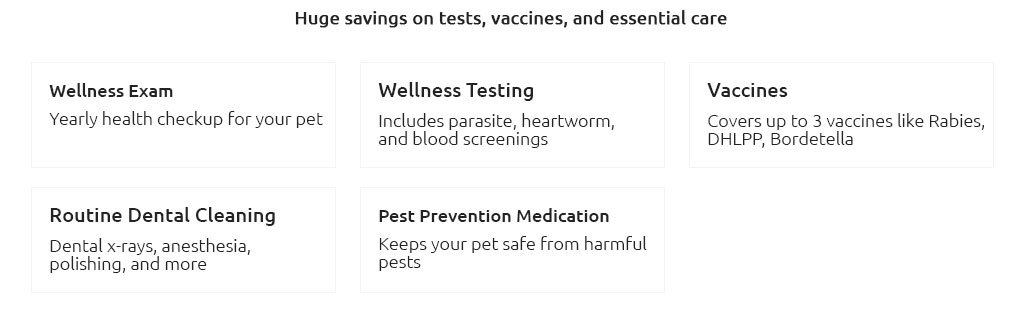

- Wellness add-ons: reimburse vaccines, exams, and preventives if you prefer predictable budgeting.

Deductibles and reimbursements, decoded

An annual deductible is simpler: you pay it once per year, then the plan reimburses at your chosen rate (say 80%) up to the annual limit. Per-incident deductibles exist but can feel unpredictable if you have multiple issues in a year.

Claims and day-to-day experience

Many companies approve straightforward claims in roughly 2 - 10 days. Some boast instant decisions for simple invoices, while complex cases take longer. Expect annual limits from around $5,000 to unlimited; higher limits cost more but reduce second-guessing.

A small real-world moment

After your beagle swallowed a sock in Hoover, the emergency clinic emailed the itemized invoice to your phone. You snapped two photos in the insurer's app, added the vet's notes, and got an approval four days later - 80% reimbursed. Your timeline could differ, but the process felt surprisingly simple.

How to compare pet insurance companies in Alabama

- Shortlist three insurers that feel trustworthy and straightforward.

- Run quotes with the same variables: age, breed, 80% reimbursement, $500 - $750 deductible, $10k limit.

- Open the sample policy and search for exclusions that matter to you (knees, hips, dental trauma, behavioral therapy).

- Check waiting periods and any orthopedic exam requirements.

- Ask your vet's staff what they see processed quickly and whether they can help with claim paperwork.

- Confirm how pre-existing conditions are defined and when they might be considered cured.

- Look for 24/7 tele-vet access - handy during stormy nights.

Trust signals worth watching

- Clear, plain-language policy summaries with matching fine print.

- Transparent claim timelines and ways to contact a human quickly.

- The underwriter's name and financial backing listed openly.

- Consistent rules across quotes, contract, and app screens.

Common exclusions and Alabama-specific gotchas

- Pre-existing conditions: anything noted before your start date or during waiting periods.

- Bilateral issues: if one knee/hip had problems, the other may be excluded - read carefully.

- Parasites: prevention is usually not covered unless you add wellness; treatment may be, depending on the plan.

- Wildlife and weather: snakebites and storm injuries are typically covered as accidents, but caps and sub-limits can apply.

- Dental: trauma is often covered; routine cleanings are usually not unless with wellness.

Saving without sacrificing care

- Pick a slightly higher deductible to drop premiums while keeping 80% reimbursement.

- Pay annually if there's a discount.

- Bundle multiple pets for small savings.

- Use tele-vet first to triage minor issues and avoid unnecessary ER visits.

A simple starting point

For many families, an accident-and-illness plan with an annual deductible around $500, 80% reimbursement, and a $10k annual limit balances cost and confidence. It won't be perfect for every pet, but it's a steady baseline while you compare.

Last checks before you hit "buy"

- Verify waiting periods and any orthopedic waivers.

- Confirm coverage for prescription meds, specialists, and emergency hospitals.

- Ask about direct pay; if not offered, confirm how reimbursements are deposited.

- Look for end-of-life care coverage details.

- Make sure coverage travels with you across state lines.

If you're still unsure

Grab two solid quotes, sleep on it, and choose the one you trust to keep things simple when you're stressed. You can switch later, but new insurers won't cover old issues - so a thoughtful choice now can spare you headaches down the road.